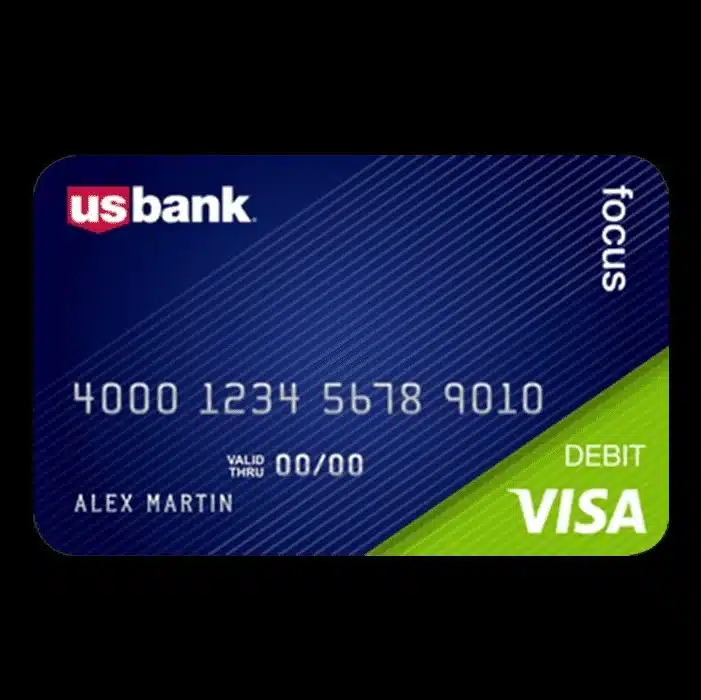

USBankFocus Pay Card gives employees the flexibility to withdraw cash or make purchases using their card. It eliminates the hassle of paper checks, reduces uncashed checks, and increases pay date certainty. Additionally, USBankFocus Card eliminates the need for an employee to visit a bank to cash checks. The card is free to use for in-network ATM transactions, point of sale purchases, and online and telephone bill payment. USBankFocus Privacy Policy, Usage Guide, and Cardholder Agreement included with Focus Pay Card.

USBankFocus Card is a Prepaid Debit

The USBankFocus Card is a prepaid debit card that accepts Visa and MasterCard. With this card, you can make purchases, pay bills, or access cash at locations that accept Visa or Mastercard. However, you must first activate it online. Once you do, you can use your card at any merchant that accepts debit cards. You can also use your Focus Card to pay your bills online, via phone, or mail order purchases. USBankFocus Card is a great option for individuals who live in an area where paper checks are not readily available.

Using your USBankFocus Card will give you access to thousands of in-network ATMs. In addition, you can receive cash back on purchases. Plus, if you have a direct deposit, you can load a portion of your pay onto your Focus Card. It’s a great way to keep cash separate from other money. If you have a lot of cash, this card will help you make the most of your funds. It’s easy to use, and you can get unlimited cash withdrawals at Money Pass ATMs.

If you are a state employee, you can deposit your pay directly to your USBankFocus Card. You don’t need a bank account, and you don’t need to undergo a credit check. It also saves you time, because you don’t have to wait in line at the bank to deposit or cash your checks. You’ll never have to spend more time than you have to. You can use your Focus Card for everything from dining out to online shopping.

USBankFocus – Benefits For Employers & Employees

If you’re interested in enrolling your employees in the USBankFocus program, you’ve come to the right place. In this article, we’ll explain how to get started with this company-sponsored card, and also discuss how it benefits employees. This employee benefits program is an excellent way to streamline the payroll process while allowing your employees to enjoy convenient access to their funds. Using the Focus Pay Card, employees can easily access their funds on their own or use it to make payments. You can also use it to reduce the number of uncashed checks.

UW’s employees can use their new USBankFocus Card to make online purchases. It can used for both shopping and banking. The Focus card automatically loads funds each payday. It is also protected in the event that the card is lost or stolen. If your card is stolen, you’ll get notifications of transactions made on it and can easily transfer money between your bank account and your card.

USBankFocus Cards are reloadable prepaid debit cards that accept both Visa and MasterCard. They are a convenient alternative to paper pay checks. You can use the Focus card anywhere debit cards accepted. You’ll be notified of any transactions via text or email, and you’ll able to view account detail online. You can also access your cash at any Visa member location. These benefits and many others make the US Bank Focus Card a valuable option for busy people.

US Bank Focus Card

The USBankFocus Card provides flexibility for employees to withdraw funds and make payment transactions. It also eliminates check cashing fees, increases employee pay date certainty, and reduces outstanding uncashed checks. The card is available for free at in-network ATMs and bank teller locations. US Bank employees can use their card for on-line shopping, bill-paying, and point-of-sale purchases. However, the card carries a small fee: $15 for expedited and overnight delivery of your payments.

The USBankFocus Card is a Visa prepaid debit card. It offers many benefits over a traditional paper check, such as direct deposit. It can used at merchants that accept debit cards. It also provides account detail and automated text alerts. With the card, you can make purchases and pay bills online, over the phone, or through mail. If you concerned about the security of your financial information, you can call the bank’s customer service representatives for more information.

US Bank Focus – How to Use the Focus Pay Card

Focus Pay Card gives employees flexibility in withdrawing and using funds. It increases employee pay date certainty by reducing check cashing fees and allowing the employer to load funds directly to the employee’s card on pay date. With the Focus Card, employers can eliminate paper checks from payroll and reduce the number of uncashed checks. However, to use the Focus Pay Card, an employee must update their information on USBankFocus .

First, activate your card online. You can access your Focus Card anywhere MasterCard debit cards are accepted. You can even sign up for alerts and other services through your card. To get started, create an account and enter your 16-digit Focus card number. Once you’ve created an account, follow the enrollment prompts and you’re ready to use the card. Use your card online or at any merchant that accepts Mastercard or Visa. The card can used worldwide and can be deposited into USBankFocus , credit unions, and many other financial institutions.

USBankFocus – The Perfect Card For Employees

You may be wondering what USBankFocus is. This card has several features that make it the perfect card for employees. It allows you to load funds directly on the employee’s card on pay day, eliminating the need to use a check cashing service. Additionally, you’ll never have to pay a fee to withdraw money at an ATM or call your balance. In addition, you can use this card to make point-of-sale purchases, pay bills, and make online purchases. In addition, there no fees associated with this card, with the exception of a $15 fee for expedited and overnight services.

If you’d like to start using the Focus Card right away, you’ll need to sign up for direct deposit at your employer. The process is simple and secure. You can easily fill out a form online and receive your payments on the card within minutes. You will automatically enrolled in the Focus Pay Card program if you’re an employee of UW. The card is a debit MasterCard issued by USBankFocus . You’ll notified each time a transaction occurs, so you can sure your funds will safe.

USBankFocusCards a convenient alternative to paper pay checks. They accept Visa and Mastercard as payment methods and allow you to make purchases almost anywhere debit cards are accepted. You can also receive automated text alerts regarding your balance and other important information. And of course, if you need cash, you can make purchases at participating locations that accept Visa. You can even get a prepaid card for cash through your local bank. So, why wait? Get the US Bank Focus Card and start spending your money the way you want to. You’ll glad you did!

USBankFocus Card – Reloadable Debit Card With Cash Back Program

The USBankFocus Card a reloadable debit card that accepts Visa and Mastercard. You can use it to make purchases, pay bills, and access cash from thousands of in-network ATMs across the country. If you looking for a prepaid debit card with a cash back program, this one may right for you. Activate your card online before you start using it. Learn more about this card and its features below.

The U.S. Bank Focus Card is a convenient, prepaid debit card. Unlike paper pay checks, the Focus Card is available for use anywhere a debit card is accepted. The card offers account details and automated text alerts. You can also access cash anywhere Visa members accept cards, as well as from ATMs and merchants that accept cash advances. It is a convenient way to manage your money without having to carry cash or use a checkbook.

USBankFocus Pay Cards

A focus pay card can a convenient solution for employers to give their employees the ability to withdraw funds and make payments anywhere. By utilizing this type of card, employees can have greater pay date certainty and eliminate check cashing fees. With this type of card, employers can load funds directly onto an employee’s card on the employee’s pay date. Additionally, a focus pay card can eliminate paper checks from the payroll process, reducing the amount of uncashed checks. However, employers need to update employee information with USBankFocus when using this type of card.

USBankFocus cards are Visa prepaid debit cards that work everywhere MasterCard and Visa are accepted. The Focus card can used anywhere a debit card is accepted and saves a person from the hassle of writing and keeping track of a paper pay check. Users can access their cash at thousands of Visa member locations nationwide to make purchases and make deposits. A US bank focus card is a convenient alternative to a paper pay check.

The USBankFocus card allows you to make unlimited free withdrawals at Money Pass ATMs and earn cash back on purchases from merchants. You can even load a portion of your pay on the card using direct deposit. The Focus card is the perfect way to keep your cash separate from your other money. Once you’ve signed up for a focus card, you’ll glad you did! The benefits of a focus card many.

The USBankFocus Debit Card

A USBankFocus card a reloadable prepaid debit card that accepts both Visa and Mastercard. It can used for purchases, bill payments, and direct deposits. The card also provides access to cash at in-network ATMs nationwide. To use it, simply activate it online. Then, you can use it everywhere Visa and MasterCard accepted. You can also use it to make online and phone purchases.

Your Focus card is accepted wherever Mastercard debit cards are accepted. This is a great convenience for those who do not want to deal with paper pay checks. You can also access your card from ATMs, merchants, or even your smartphone. You can also view your account’s details and receive automated text messages. You can also withdraw cash at any merchant that accepts Visa. However, you should aware that if your card is stolen, you may liable to face a fee.

US Bank Focus Card

The USBankFocus Card is a Visa prepaid debit card that offers a simple, secure and convenient alternative to paper pay checks. The card works wherever debit cards accepted, including ATMs and online. It also features an account balance and automatic text alerts. You can withdraw cash from the card at any ATM or merchant that accepts Visa. Getting cash quickly and easily is convenient, because you can access the card at any Visa member location or use it for cash advances.

The USBankFocus Card offers the convenience of reloadable prepaid debit cards with a direct deposit feature. The card can used for many different purposes, such as bill payment and purchasing items. The card also provides cash back rewards at participating stores and restaurants. You can even use it for online purchases, phone purchases and mail orders. Once you have activated your card, it can used anywhere Visa and MasterCard are accepted. The card is safe, secure, and backed by an FDIC insurance policy.

With the USBankFocus Pay Card, employees can withdraw funds and use their card to make payments. They can avoid checking the mail for pay stubs or paying check cashing fees when they use their card for payroll transactions. Employers can load the employee’s card on pay date to cut out paper checks from the payroll process and reduce uncashed checks. To get the Focus Pay Card, you need to update your US Bank account information.

The Focus Card from USBankFocus is a prepaid debit card that is accepted at places that accept Visa and MasterCard. It an excellent alternative to paper pay checks and is free to use anywhere debit cards are accepted. The card also provides you with account details, including a balance, and can used anywhere that accepts debit cards. With the card, you can get automated text alerts on your account balance and make purchases online, by phone, or through mail order.

The USBankFocus Card offers a variety of benefits, including rewards for shopping at select stores and restaurants. You can also access cash with your card at thousands of in-network ATMs. However, if you lose your Focus Card, you must immediately report it to protect yourself from liability. To avoid charged for unauthorized purchases, you can use the Zero Liability program provided by US Bank. You will charged a standard text messaging fee, depending on how frequently you use your card.

US Bank Focus – Payroll Easier With

USBankFocus

If you’re looking to make your payroll process easier and save money, you might want to use the USBankFocus Card. This card lets you load funds to an employee’s card on their pay date and has no transaction fees. You can also use it to pay bills and make on-line purchases without cashing a paper check. The only catch is that you’ll need to update your US Bank account information. You can learn more about US Bank Focus here.

The Focus Card has numerous benefits. Among them unlimited free withdrawals at Money Pass ATMs, cash back on purchases, and direct deposit. The card also offers free access to tens of thousands of in-network ATMs nationwide. You can also use it to load a portion of your pay onto the card. The USBankFocus Card is a great way to keep your cash separate from your other money. It offers many more benefits than just a debit card.

With the USBankFocus Card, you can access your money anytime and anywhere. It works as a reloadable prepaid debit card and accepts Visa and Mastercard. The card is useful for bills and online purchases, but you can also use it for mail-order purchases. Just make sure to activate it online first. If you don’t have a credit card, the US Bank Focus Card won’t work for you. You can use a debit card anywhere, as long as it is accepted.

With a Focus Card, you can also deposit your pay directly to any bank account. This eliminates the need for a bank account or credit check, and over one million businesses now accept it. In addition, if you have a USBankFocus account, you can even transfer money to your card. Once you have your Focus Card, you can use it anywhere that accepts Mastercard. This card easy to use and will make your job easier.

If your company offers a credit card, you should look into USBankFocus Pay Card. This card allows employees to withdraw cash at in-network teller machines and ATMs, with no additional fees. It also works with US Bank, Money Pass, and internationally accepted ATMs. You can also withdraw cash from any teller location for free. You can also opt to have the card shipped overnight for an additional fee of $25. To learn more about US Bank’s Focus Pay Card, read our guide.

The USBankFocuss Card works like any other debit card, accepting Visa and Mastercard. The card automatically loads funds each payday and alerts you when a transaction occurs. The card accepted around the world and can used anywhere Visa and Mastercard debit cards accepted. It also gives you access to cash at thousands of in-network ATMs nationwide. In addition to convenient, the card is protected against theft and loss, and offers direct deposit.

The USBankFocus Pay Card provides flexibility for employees, eliminating check cashing fees and increasing employee pay date certainty. The employer can load funds directly on an employee’s Focus Pay Card on the day of pay. With this convenient service, employees no longer need to worry about missing a pay date and can access their money anywhere that accepts debit cards. The card also offers automated text alerts and account detail. Additionally, the card can used for withdrawing cash at any Visa-member merchant location, ATM, or cash advance facility.

USBankFocus Card For Your Employees

With the USBankFocus Card, your employees can withdraw cash and use the card to make payments. Withdrawals free when made at an ATM or at a bank teller. You can also use the card to make on-line purchases, pay bills, and purchase merchandise at USBankFocuspoint of sale without paying a fee. To use the Focus Card, you must update your US Bank account information. You can download the Focus Card account application, Usage Guide, and Cardholder Agreement.

The USBankFocus Card works anywhere a Mastercard debit card accepted. There several ways to access your cash and keep track of your spending. The card also comes with free unlimited money-pass ATM transactions. You can also receive cash back on purchases with the card. The card offers the convenience of automatic load, so you never have to worry about missing out on a paycheck. It also works at over eight million merchants worldwide.

USBankFocus Credit Cards For Businesses

If you have looking for a credit card with great features and a reasonable price, look no further than USBankFocus . This credit card has many benefits and designed for businesses. In this article, you will learn more about the advantages of this card and how it works. Once you’ve received your card, you’ll ready to get started. Then, take a look at the many ways it can benefit your business.

Activate your card online to use it for online and offline purchases. With USBankFocus Cards, you don’t have to write a check. The pre-paid debit card works like any other debit card and accepts both Visa and Mastercard. The card also allows you to use cash from thousands of in-network ATMs nationwide. In addition to convenience, the Focus Card gives you direct deposit and automatic funds loading each payday. You can use the card to pay bills, shop online, or use it for mail-order purchases.

If you’re an employee who gets paid with direct deposit, you can use the Focus Pay Card anywhere MasterCard debit cards accepted. This card eliminates check cashing fees for both employers and employees. With USBankFocus Pay Card, you can load money directly onto your employee’s card on the employee’s pay day, eliminating the need to use a paper check. By utilizing the Focus Pay Card, you eliminate the need for paper checks and save money on postage and processing fees.

USBankFocus – A Simple Way to Track Your Spending

If you’re looking for a simple way to track your spending, the USBankFocus Card the perfect option. This Visa prepaid debit card offers a number of benefits, including the convenience of cashing out wherever debit cards accepted. You can also receive automatic text alerts, account details, and more. You can also use your card to access cash at Visa member locations, ATMs, and any merchant that accepts cash advances.

A USBankFocus card a reloadable prepaid debit card that accepts Visa and Mastercard, and it also provides direct deposit. With a focus card, you can make purchases, pay bills, and get cash at thousands of in-network ATMs nationwide. However, you must first activate your card online. Then, you can use it in stores and at online retailers. You can even make purchases through mail-order companies.

Employees can use their USBankFocus card to withdraw funds from a bank or ATM and make purchases. It has eliminates check cashing fees and increases employee pay date certainty. Employers can load funds directly onto a Focus card on the employee’s pay date, eliminating the need to write and cash paper checks. With this convenience, your employees can use the card to make purchases, pay bills, and shop online. All transactions safe and secure with no fees. To use your card, you must update your US Bank account information.

For Getting More Information Click here Daliybiztime